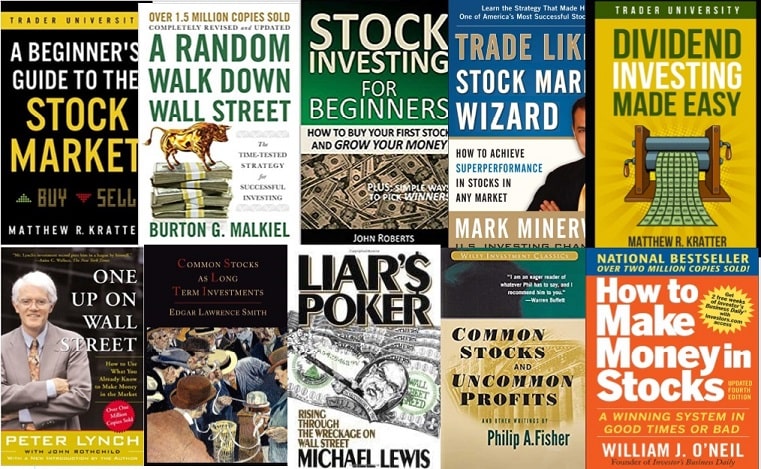

Best Books That Teach Investing In Stocks

1-How to Make Money in Stocks: A Winning System in Good Times and Bad, by William O'Neil

The Gold Standard of Successful Investment

In the stock market, there are numerous methods of trading/investing. There is value investing (like Warren Buffet), day trading, swing trading. This book is about investing in growth.

That is, investing in businesses that show excellent earnings and revenue growth (which during a bull market period are the things that influence the price of a stock). It's not worse or better than the others. But it is easier to read, thanks to Bill O'Neill and his Investor's Company Daily service.

This is because half the job for you is handled by IBD (the newspaper/service that accompanies this strategy).

The book would tell you, for example, to search for businesses with a certain amount of earnings growth per year, and that sounds like a lot of work and it would usually be. But if you pay $10 a month for that article, or whatever it is, all that stuff is done for you.

For any stock in the market, the data is available, and you are given a list of the top 50 stocks that meet the requirements specified in the book.

But that's only half the job like I said. Knowing the stocks to purchase is simple (thanks to this approach), but the hard part is knowing when to buy them and when to sell them.

The book goes through this in-depth. It includes checking in the price charts for certain trends (also available via their service) and then purchasing if the price goes above a certain amount. Then there are rules for when to sell, as well.

It is a rules-based system, which is nice because it gives you a set of guidelines for buying and selling stocks, but there is space for flexibility that can make or break you as a stock trader (depending on your expertise as a technical analyst and/or your knowledge of a specific company).

I should finish this analysis, though, by saying that in stocks, most traders lose money. I'd suggest buying a mutual fund instead unless you're so obsessed with stocks that you're prepared to put in hundreds of hours (just like any hyper-competitive skill) before you're successful.

It's a lot less hassle, and your returns are likely to be equivalent for a long enough period of time unless you become an elite trader.

If there's some bad thing I have to say about this book, it's that it doesn't say much about what I think is the toughest part of trading. The psychological factor. For that, I would reference Mark Douglas.

Best Market Advice Likely To Get.

It's an awesome book that explains everything precisely what the most successful stocks have done to prosper and when to buy the stock before it shoots up. The basic principle of the book is to purchase businesses that have shown and have good fundamentals with certain chart patterns (the patterns explained in the book).

So far, I have made 15% returns on my investments in just 3 months of investing with his approach. I had to wait at least a year or two before reading this before making that kind of money. He does, however, ask for his website in the novel.

I was cynical at first about someone wanting to offer financial advice (everybody seems to be asking you for business advice nowadays), but I decided to try his website. They give you a free month's trial, and after the trial, it costs $30 a month. The $30 a month, with the amount of money I made from this novel, is a drop in the bucket of my earnings.

His site informed me to look for Winnebago (WGO) in August-September 2017, YY Inc.'s (YY) fantastic 25% shoot up after their incredible quarter in November 2017, and Square's (SQ) ungodly boom in November 2017, to provide precise examples.

These are but some of the success stories that I would never have noticed if I had just read the book and tried to do the website's review for you. I highly recommend reading the book and paying for the website's monthly membership. I didn't regret it at all.

You're going to go from having NO stock market understanding to being able to make good choices across the market.

This book is going to change your financial life. I had the time to research this as if it were college coursework-take notes, make summaries, and refer back and forth until I was sure that I understood the concepts.

I have gone from having no knowledge of the stock market to being able to make smart market choices. I've paid a lot of dollars back on my savings, and William O'Neil provides a secure and successful way to invest by using your financial versatility as a small capital investor in your favor.

Very useful for both newbies and veterans on the stock exchange.

This is by far the most valuable book I've ever read as I try to grasp the stock market. It is genuinely a winning scheme, followed specifically in the medium and long term. It is well worth reading from its lessons on fundamental analysis to its very in-depth samples of technical analysis.

I'm a professional, and this book has helped to improve the way I search for stock entry points and how I treat stock fundamentals. It's so helpful, you don't mind the Investor's Company Daily attempt (which, as it turns out, is also well worth the investment). Strongest 5-star rating I've ever given before.

2- A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today, by Matthew R. Kratter

A Lifetime of Advice.

When I was about 27 years old, I picked up a book by Andrew Tobias called “The Only Investment Guide You'll Ever Need”. That book opened up a whole new world for me and contributed to a lifetime (profitable) obsession with investment and trading. Sadly, I eventually lost (or tossed) that book, and wished I could find it again, even though it was obviously out of date.

Matthew Kratter's book is the same kind of book, just, maybe, better. He summarizes several different approaches to investment and trading and offers solid tips and tools to get started, including some of his own books (fair enough).

If you want to start with a blue-chip world of buying-and-holding dividend collection or try a more competitive world of trading options or something in between something there's here for you. Looking back at my highlights, I find advice as varied as the basic “Only losers average losers” to more sophisticated principles such as using a stock float to make trading decisions.

A great book for a new investor on the stock market. Simple to read and up-to-date.

I've read a couple of Matt Kratter's books. This book is an excellent guide for beginners and even investors who have casually invested in the stock market or used 401k accounts, but have not thoroughly grasped how the stock market operates, and the many acronyms and meanings that come with it.

It provides an excellent summary of some different techniques that could be used by an inexperienced investor.

The author also links to websites with information related to the current chapter, including a calendar of new IPOs, Warren Buffets' current holdings, and many other helpful websites.

If you don't have the time to read a 600-page book like Benjamin Graham's “The Intelligent Investor” I would highly recommend Matt R. Kratter's “A Beginner's Guide to the Stock Market”

Concise and easy to understand. Connects the ‘dots.' Sure, I've made some bookable profits.

This is Kratter's first book to be read. In this writing, Mathew describes words and phrases that I have never read anywhere else. All of Mr. Kratter's books are great. The most important concern is one's willingness to ‘make money' with Mr. Kratter's mentoring, coaching, and wisdom. I have actually accumulated substantive gains.

My trading styles run the gamma; options, position, swing, long, short, and/NQ intraday mini (and now the recently introduced micro). The books are short, but the coverage is long due to Mathew's ability to describe complexities in a succinct manner so that beginners can grasp them quickly. Subscribe to the you-tube of Mathew.

My road to significant bookable gains combined the re-reading of each book at least 3 times to catch every detail, subscribing to Matt's you-tube and using defined-danger (think Risk only then reward) trading strategies.

I wouldn't listen to the ‘noise' put out by ‘talking heads.' Knowledge of Options significantly expands my ability to trade everything else, since Expiry Date Involved Uncertainty offers a hint as to the expected price movement.

This is the reason why I'm advised to read all of Matt's books. You'll have a lot of ‘ah-hah' moments to read Matt's trading tactics (for example) relating to, let's say, rubber banding. Okay, first think Risk, second reward, and then go make bookable profits. Don't think about defined-risk losses-how that you learn.

Consider a defined-risk loss, how much is easily accepted, like education. You're going to pay ‘tuition' one way or another.

Simulated trading is useful for studying the fundamentals of your chosen platform, but not much more. You have to put your money at risk to really, really understand. Oh, by the way, don't discuss your interactions with anybody else, as they will eventually crush your excitement with their fears, ignorance, know-it-all attitude, and stupidness.

Read to the Financial Wisdom!

This is a perfect book to read if you're trying to invest in the stock market. The reading sense is simplified to the degree that everyone can acquire knowledge and wisdom about how to invest in stocks.

The author goes into full depth about stopping “margin trading… Short inventories… 52 weeks of peaks and lows, etc.” Excellent material for beginners like me.

If you're hungry for financial independence like I am, buy this book! Matthew R. Kratter is what I consider the stock investment grant card.

3- A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing, by Burton G. Malkiel

A strong fundamental investment book, and it's easy to understand.

I read the first edition of the book a little while ago, and it did a fantastic job of summarizing the study and describing its consequences for the average investor in a way that was open and understandable to non-academics.

The new version has been revised on the basis of more recent analysis and with slight changes, the underlying and time-tested approach remains true today: for the small investor, the most effective investment strategy is to purchase and maintain a well-diversified portfolio of low-cost actively managed index funds.

I strongly recommend this book to anyone who is interested in saving and investing for a secure retirement.

A comprehensive overview of investing with depths that are too deep for a very simple message.

I started with the hard-bound edition of this book from my local library and ended with the softcover version from Amazon.

Burton Malkiel offers a very broad description of how our securities markets are organized, how they work and how we deal with them. This involves a history lesson in bubbles, booms, busts, depressions, recessions, and rallies from the Tulip Craze to the present day. Malkiel includes everything from equity to bonds to mutual funds and more. There are chapters on graphing, modern portfolio theory, and CAPM.

Though this book is supposed to be an outline, there's a lot going on… And, well, I mean ~ a lot ~… Here's some information. The text reads like a professor at a university attempting to give an informative lecture or presentation.

Some of the chapters, including the history of market fluctuations, I found it fascinating to read because I like history in general-the whole how and why of events and their effect on how we got to today.

I really appreciated the chapters on behavioral investment and psychology. Other chapters, like charting, beta, and government-backed bonds, didn't captivate me a lot. The knowledge was often too technical in nature and seemed like a bunch of hooeys to me, or it just didn't relate to my personal investment strategy.

The entire text can be boiled down to a few main concepts.

First of all, the market is irrational and unpredictable. Don't try too hard to get out of it, or time it's just right. Blips and dips in security prices, random world incidents such as terrorist threats or political scandals, and unjustified exuberance or pessimism are too much for anyone or anything to deal with. You're not going to win. You could get lucky and think you won, but you could have lost just as easily. And there's a random walk.

Two, despite all the dirt in #1 above, investing in the stock market still beats any other investment in the long run. Don't fall victim to jittery emotions or the whims and wiles of “professional” investors with doom and gloom tweets. As Warren Buffett said, the best time to keep is forever.

Three, it's not easy to pick a winning stock. Suppose you're a young investor with a small amount of money like $5k. How are you going to spend it? Do you feel secure that you can pick up a stock or two? Are your picks going to beat the market average? Maybe, if you want the right one under the right conditions.

However, the safest way to invest in the market will be through an index fund that represents the very market in which you want to invest. The index fund, either as an ETF or a Mutual Fund, would contain a little of all that represents the index to which it is benchmarked. The SPY will follow the S&P, DIA will follow the Dow Jones, QQQ will follow the Nasdaq 100. So, why risk choosing one or two stocks when you can have all of them?

Four, diversify the diversification. Index funds diversify the capital from a variety of securities. By investing in foreign funds, you will go further and diversify. The idea is that some foreign funds will outperform US funds. They may also “zig” when the US funds “zag”

Five, and eventually, miss the services of a competent consultant. He's not a genius or a sorcerer. You can do as well as you can if you can't do better.

You should be able to open up every index fund to see exactly what it holds and how much it holds. For example, if you want to know what SOXX holds, go to the iShares website and look at it. It's all right there. Instead of buying SOXX, I can bypass the middleman and his approximately 0.5% fee and only buy those securities… Or at least the top 10 of them.

Many investment companies, such as Fidelity, offer fractional trading down to 0.001 shares as long as the corresponding selling price is at least $0.01. Now, that means you're supposed to do some work and learn how to follow the stock. At least you've got a starting point.

Further, presume that you have rolled over a pension or 401(k) into a conventional and/or Roth IRA. You may find yourself with a significant amount of money, like $100k or more. With money like that, you can build up a serious version of your own index fund equivalent of 20 to 80 securities anywhere.

Now, I'm going to counter myself and repeat what I said above. This will require a bit of work over a long period of time. You've got businesses to keep track of all that. It might be like a second work, in that case, maybe a simple all-in-one index fund is all you need.

With regard to 4, I think you can use some of the advanced charting tools or total return calculators available from your broker or anywhere else online to compare how US securities performed compared to foreign securities.

Compare some of the best US funds like QQQ, SPY, SOXX, and IGV to country-specific funds that concentrate on New Zealand, China, and Russia. If you see that these foreign funds have outperformed their US counterparts, then you have a starting point for an international diversification event.

Personally, I haven't seen it. I have seen US-centric ETFs and securities significantly outperform the majority of foreign funds. Diversification would not make any sense here. Why will I divide the money between two markets, one that can grow by >8% per year over 10 years and one that can grow by ~4% per year over 10 years?

I'd rather pour everything I can into the most strong instrument available. If something better happens in a couple of years, then I'm going to sell one and buy the other. Or, even better, but more stressed defense knows it's going to recover.

So, though I don't agree with all that Malkiel says it provoked a lot of thinking in my mind, and for that, I'm giving it a full 5 stars.

4-Stock Investing For Beginners: How To Buy Your First Stock And Grow Your Money, by John Roberts

You will finally understand stocks!!

This book is a brilliant work!!! Years ago, I tried to get into stock, and none of the guides I came across for beginners made any sense, so I gave up. I wanted to give it another shot and some references caught the very basics like “what is a stock?” “Why is investing important?” but then sent me back to the loop.

I've vowed not to give up again, and that's what brought me to this novel. John Roberts simplifies ALL! He places it in a relative context so that you can grasp it better.

Like claiming the trade is essentially an auction. He compares something new to something familiar, so that you can appreciate it better. It helps a lot to say it this way. And I enjoy having a book based entirely on stocks. Other references start tossing in bonds and funds when you scarcely grasped the stock, to begin with, leaving you twice as puzzled.

I really appreciate that he reiterates the crucial things because sometimes I miss something and I end up going back and trying to read it again, so he brings up the points again to make it easy to stick to them. And I need the reminder to be new to the stock market.

After reading this book, I was finally able to get a stockbroker account and start investing with confidence. Which I never imagined I would be able to do. I can't wait to read the rest of his novels!

A very informative book!

I'm incredibly new to saving my hard-earned money, making it sit in my 401k for my boss, I took advice from Mr. Roberts and rolled it over to my employer (new Ameritrade account I just opened). Currently, with that being said, I had 30 days to deposit $3,000 into my account to buy and sell transactions.

There were a bit of detail on the login tab, and I got really frightened and scared AT FIRST, then I took two deep breaths and whispered to my subconscious, “keep going you got this”

Of course, I did it. Today, to the newsletters he lists for Oxford, GMO, I was on the web and they ran a special one to get a bunch of $99 for the cheapest membership, which was regularly $249, and you get that I guess it was like 4 or 5 bonus materials.

I'm interested, but I fear it may be a bit too advanced for a beginner like myself. I need to encourage myself to get acquainted with the “trade” first before any of the content can be of any benefit to me.

Today, as far as Mr. Roberts' book itself is concerned, I completely enjoyed it, and I'm so excited to buy my first stock. I'm still buying his other novels, The Upcoming Paychecks and Raises, and a lot more.

I like how he simplifies it for beginners, the stock vocabulary that I can really relate to by using daily words!!! This BOOK IS FOR THE BEGINNERS FOR THE TITLE SAYS, but if you are more Experienced IN THE Area, this BOOK is not for you, because you know this Stuff.

The fundamental foundation was presented in a non-technical but yet competent way.

Quick (60+ pages) and easy with a touch of humor and a range of online tools. It offers a very basic base and discusses a lot of his own personal approaches and resources; does not at all pressure and does a decent job of incorporating basic words in a straightforward way, blending them into the subject he is addressing.

This book is not going to take you very far, but it is an excellent place to start and not a technical one.

5- Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market, by Mark Minervini

I was patiently waiting for his next book when I was reading this game-changer. I began trading back in 2013 and quickly read 50-75 books and books on the market. I simply can't get enough of that!

It was this book that, after reading it in 2015, I began scanning stocks entirely differently. The teachings I've read here have helped put me in a life-changing game of winning. I can't wait to read his latest book and begin trading on my journey.

If you're an aggressive trader, that's one hell of a book.

This is a must-have-book for any trader’s library. His techniques are well explained, and if you read HMMIS (How to make money in stock) this book is a perfect match. It's not a book you should read only once, you need to take a few passes and do it with a highlighter. I just purchased his second book, and I'm dreaming about taking his workshop.

Well written, rich in good knowledge, and easy to understand.

I can't say enough positive stuff about this novel. I love investing/stock market books, and that's pretty much all I've read. I've finished this in a month, a new record, because it was easy to read, easy to understand, and full of great knowledge. I couldn't have put it down.

By saying that it was easy to read, I don't mean that it was simple in some way because every page had a lot of great material, including some stuff I haven't read in any of the other books. He clarified the words in an easy-to-understand language because I hate having to look at technical terms that some writers think everybody should know.

I thought his approach could be a little dangerous, but he gave the details that I needed to see it wasn't.

I've read valuation books and technical analysis books, but this was the first one I've read about momentum investing (he does use technical analysis, too). I was shocked that he didn't give much credence to P/E valuation, which goes against everything I've read so far, but his logic made sense that you can't find the best stocks in the bargain bin.

He provided advice as to when to know when the P/E is too high, and I was shocked that he stressed getting an exit point (not buying and holding the mind) when the stock shows a topping trend and goes down to Stage 4.

He's been repeating stuff a little, but I appreciated that. I need that to hold some of the ideas in my head. I read it a second time, and I find that I'm absorbing a few points that I missed the first time. I think this guy is a wonderful writer, I appreciate that he's sharing his wisdom with us, and I'm planning to buy some of his books.

6-Dividend Investing Made Easy, by Matthew R. Kratter (Author)

Gets to the point of exactly what you need.

Do you know how wordy some of the authors are? How do they never get to the point, or give you some useful information? Or how do they publish books that obviously haven't been edited or may have been written by a pre-teen? Yeah, yeah, that's not one of them.

This book is impressive for a fast reading. It's not an encyclopedia for traders, but it's the best advice you can get when it comes to trading. Namely, don't do that. Invest. Invest. That's how you're accumulating money.

The author has written simply, accurately and succinctly. There's no waste of time going over filler words designed to make you think you're reading a book when, in actuality, what you're getting from the practical use could have been put on a sticky note. This is both substantive and actionable. In reality, I've already been following his advice and making money! Bravo! Bravo!

You could spend time and money trying to get through some really deep investment books, or you could just do as it says. Bottom line, this is what Warren Buffett has achieved with a roaring success. Start right here to save money and make some money. You're not going to regret it.

A highly informative book.

This book had a lot of useful details about saving dividends. The author listed a range of companies that paid dividends and provided strategies for what to do when the market was down (buy stock instead of selling and don't panic). Investing in dividends is a safe way to create wealth over the years.

Matthew offers sound advice in his novel, and I'm going to follow him. Nice book and I highly recommend it to you.

Dividend investing made easy by Matthew Krater

As the author says in the book, “it’s not lengthy, but it's jam packed full of information” which it is. I lent it to my friend to read because he's planning to start saving in the new year and asked me which book I suggested he'd read first. I went straight to my bookcase and took this one out to read it. It's worth the price it sells for, and I gave it a 5-star review.

7- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market, by Peter Lynch (Author), John Rothchild

A Blast of Wisdom

So, here we have an artisan unveiling the secrets of his craft. I really couldn't give this piece enough praise. I think the only thing I can say is that this book made it to my car… and it stayed! A ton of books has taken a few trips with me in my car just to get back to the shelf. I only happen to have two kids (4 and 2) so I've spent a lot of time in my car for the last 4 years (you know, to get them to nap). So, as they were sleeping, I read. And reading is a good thing because I don't have a lot of time for it.

Now, go back to the novel. This book is known for showcasing some of the advantages that retail investors have (say, over institutional ones) when it comes to seeking investment opportunities. One of these benefits relates to the fact that-due to a mandate or a sheer size-institutional managers cannot even begin to consider investing in small caps.

This leads to the second advantage, which is that retail investors can find very interesting opportunities by looking around them. This benefit is even more valid today, given that everyone has easy access to the data stored and relevant to the business.

This is one of those books where, if you randomly select a paragraph on every page, you can find a way to keep you engaged. The style of writing is just too sweet. And I think it's a good thing, because this man is pure wisdom.

He might have stood in front of me for the rest of my life, and that probably wouldn't have been enough time for him to pass on all his information. He was an investor, a broker, an equity analyst, a portfolio manager, and a businessman. Unbelievable!

The three parts that I find most valuable are:

1-Corporate/stock classification (slow/fast producers, stalwarts, turnarounds, etc.)

2-A description of the features of a fast grower or a 10-bagger.

3-Details of the impact of interest rates on the market's historic P/E ratio.

Do your own favor and read this book. You're not going to regret it.

A must-read for those who are interested in investing.

I've heard about this book from a variety of sources, and it seems to be highly recommended for those interested in investing. Lynch is well known for his “invest in what you know” slogan, and even though some people take it as an excuse to invest in whatever business they actually “feel good about,” Lynch is nowhere near as careless in his book and even warns against it.

Its core idea is that people, including me and you, take part in the economy and are well aware of emerging developments and investment opportunities. By being aware of and doing careful research before investing, you can find a variety of “baggers”-stocks that increase by multiples over time-that can make you very rich.

In fact, Lynch points out that this gives the average person an advantage over skilled investors, thus giving the book its title. Throughout the book, he outlines his ideas and strategies for evaluating companies and serves as a strong foundation for value-driven investors. The author also seems to have a strong sense of humor (like Buffett) that makes the book happy to read.

The only downside to the book I can see is that it's a little out of date, as it was published decades ago. Much has happened since then, such as the dotcom bubble and the recession of 2008. But I find this a minor concern, as the lessons and techniques outlined in the book are general enough to be widely applied. It doesn't take anything away from the content of the novel.

8- Common Stocks as Long Term Investments, By Edgar Lawrence Smith.

A must read to the well-read investor.

This book was cited as one of the causes of the Great Depression because it contributed to overconfidence on investment security among US investors. If you read Smith's excellent book and his very science based back-testing, you're not going to get the idea that Smith supports cutting out big margins and you're going to be wealthy in no time at all. It simply demonstrates that stocks greatly outperform bonds over a long period of time to his surprise.

His results have been endlessly repeated, and the results hold up over time. Excellent to read.

I have just completed reading Edgar Lawrence Smith's Common Stocks as Long Term Investments. Freshening up. Smith aims to show the wisdom of the day that bonds outperform stocks, but the study findings did not support the traditional wisdom. Stocks beat bonds in all but one of the “tests” and very handsomely in some situations.

Despite the difficulty of obtaining information, from 1837 to 1923, Smith was able to create an 85-year stock market index. The significance of such a long term chart is that it clearly illustrates the exponential nature of the market's growth.

Smith reveals that the demand expanded at approximately 2.5% annually by fitting a curve to the low points and another to the high points. If this amount seems to be poor by current standards, please take into account that stocks paid handsome dividends back then, usually between 4 and 8% per annum, as stocks will not otherwise be bought in preference to bonds.

The Smith-built chart looks very similar to any current stock chart, with lots of volatility. Smith then examined what he calls “The time hazard in the purchase of common stocks” how long it would take to break even if you purchased your shares, and the worst-case scenario was 15 years, slightly less than the duration Jeremy J. Siegel discovered in his Long Run Stocks analysis.

Essentially, Smith and Siegel realized the same thing, given the portfolio is well-diversified and holds the largest companies in the different leading sectors, a patient enough investor would never lose money on the market.

Smith then seeks to figure out why stocks are beating bonds as long-term investments. His three significant findings are as follows:

First, inflation is more likely than deflation, and bonds have no inflation security. In inflationary times, even though the face value stays the same, bonds lose buying power. Stocks, on the other hand, sometimes rise above inflation in value, as I will clarify below.

Second: the issuing company must have earnings above and above what is needed to pay off the interest and principal of the bond in order for a bond to qualify as a high grade, and this extra income accrues to the stockholders, not to the holders of the bond.

Third, population growth demands product and service growth and the businesses that supply them expand accordingly. The same impact is having on improving living standards, people are seeking more and better goods and services, and the businesses that supply them are rising accordingly. This rise is above and above inflation, since otherwise the standard of living will not be increased, quite the opposite.

Instead of depending on the hocus-pocus of charting and intricate crystal ball gazing, I previously called the work refreshing because it goes back to first principles. In turn, you own a portion of your country's productive capacity when you own stocks and, if the economy is increasing, so does that productive capacity.

Where Smith falls short is in his picking of stock. In general, he speaks about “investment management” but does not provide a superior form of stock selection. In order not to cause bias, his “tests” were based on generic methods: “In the test that proceeds, the only principle of sound investment that has been applied to stock selection is diversification.”

The buying of common stocks can not be considered without diversification. The job, better stock picking based on price charts, was left to be discovered by BuildMWell. In order to decide how careful an investor will need to be, Smith looked at the top of the price index table. BuildMWell, on the other hand, stared at the bottoms of the price index map and came to the clever conclusion that there was no better price point at which to buy if these were indeed the bottoms.

9- Liar's Poker: Rising Through the Wreckage on Wall Street, Michael Lewis (Author, Narrator)

Fluid narrative of the past of an industry, a company, and a specialist.

The narrative is very dynamic and I like the way the author bounces between the 70/80s past of financial markets, (ii) Salomon Brothers' rise and fall and (iii) his own personal experiences inside the business. From wide to narrower subjects, the amplitude of the themes varies a lot, but the author manages to criss-cross between them while keeping the ties and preserving the flow.

In addition, it is fascinating to see how transparently the author illustrates that some of the stereotypes people have towards banks and professionals in the financial markets are intensely real.

The book made me wonder how it could have been to live in such a unique workplace and sleep and dine regularly in locations that may be as amazing as some of the salaries listed: Le Périgord, Bristol, Tante Claire, Plaza Athenée, Claridge's, all paid to the expense account of the company. Some traders regarded the expense account as a soft-dollar compensation scheme, as the book states.

It captures the atmosphere on the street during the period 1984 – 1987.

I find it funny that I found this book just 31 years after it was originally published (1989).

Yes, the game back in the day was Liar's Poker. I recall one of our guys who was moving from our offices at 60 Broad Street to midtown at a ‘going away' party-we were at Michael's 2, near the Battery and had about 15-20 of us all sitting at a long table on the restaurant's left side. A couple of us started playing Liar's Poker at my end of the table, and soon there were at least a dozen of us in the game.

Yeah, we were quite noticeable and probably somewhat loud – the game began to draw attention – guys from other businesses sitting at other tables began walking over and trying to get into the game – the management came over at that point and asked us to stop the game for their liquor license's sake. They all enjoyed Liar's Poker.

This book captures the atmosphere of that time and points out some of the shortcomings that were in place back then in the financial system. Today, many of the same vulnerabilities still remain.

A good read for the historical viewpoint, and a warning for all financial services clients.

10 – Common Stocks and Uncommon Profits and Other Writings, by Philip A. Fisher

How much hard work it takes to invest in long-term growth.

A brief biography of the author written by his son – Kenneth L. Fisher – is the preface of the novel. It's certainly worth reading as it sets the tone for the book properly.

The book itself is quite old, so it may be outdated (cold war) in certain circumstances considered by Mr. Fisher, but I would suggest that much of the material is quite timeless. In specific, Mr. Fisher's formula for a strong study of long-term prospects for investment in growth (the process is referred to as scuttlebutt).

As for the book's contents, I see 3 separate areas:

1. A very thorough description of the scuttlebutt process (the most valuable part, in my opinion),

2. Insights of Mr. Fisher when contemplating unique investing-related situations,

3. A step-by-step guide to how to be Mr. Fisher is the last chapter (or work like him at least).

The style of Mr. Fisher in the wording is very formal but restrained. It was great reading for me.

For those of us who want to be like Warren Buffet when we grow up, this is another novel. It is a natural complement to Benjamin Graham's The Intelligent Investor. While this book focuses on saving value, this one focuses on investing for growth. Warren Buffett credits 15% to Philip Fisher's strategy. Because of Mr. Buffett's advice, I read this book. I'm going to read everything a man recommends when his net worth is $40,000,000,000.

My main lesson from this book was how Mr. Fisher concentrated on earnings as what defines a stock's worth. He offered an example about if you were willing to purchase stock in your high school graduation class based on what you felt would be their potential for future earnings. How can you assess the worth of them?

Should you later sell a student's stock that went on to college and had big profits only because he was overvalued then? Will you like to purchase stock from a student who went on to gain poorly only because he had more growth potential? This analogy shows that when we purchase stock, we buy corporate earnings, and what we are looking for is quality and future growth.

This book offers 15 things to look for while purchasing inventory.

Mr. Fisher also had a chapter on why he does not believe in successful market theory because stock performance often shows that they were not adequately priced because future performance is not reflected in the current price, stock traders have never been able to correctly pricing stocks, if they did not have such stock variances a year later, some go up 1000 percent some go down This book in your financial library is highly recommended to me.