What to Know About Cashier’s Checks

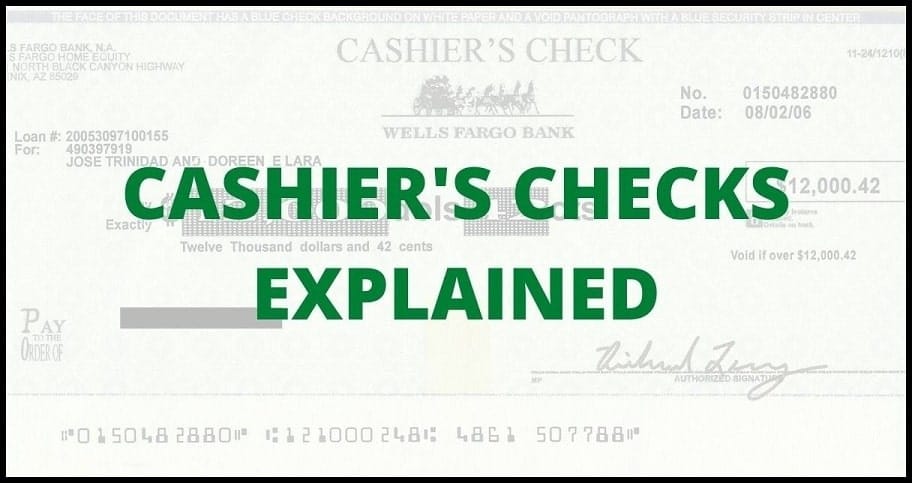

A cashier’s check refers to the checks issued and guaranteed by banks. The bank usually indicates the payee's name and the amount on this check to enable them to collect funds at their preferred outlet.

They are better than personal checks as they cannot bounce, but fake ones can lead to serious problems in your account.

And though there are many modern alternatives, they remain a viable payment option amongst many bank users. Provided it's legitimate, it’s among the best ways of requesting or making payments.

Why should I go for a Cashier’s Check?

Many situations may necessitate you to go for a cashier’s check, including making large purchases for buying a house or a car. These are cases where the use of credit and debit cards are not ideal.

Besides, cashier’s checks have extra security features, including bank worker’s signatures and watermarks, making it hard to fake them.

Therefore, you will be confident in the security of your transactions. Additionally, the risk of fraud and theft are their lowest when you use this type of check.

Also, unlike the personal checks, the bank will be paying with their funds. Therefore, if you have an insufficient balance in your account, then the check will not bounce.

A cashier’s check is not used for everyday needs; it ensures security for both parties. The recipient is confident the check won't bounce as it's directly from the bank’s funds.

Additionally, you won’t have to share the details of your account information with the payee. Finally, the funds will be available in only one business day, and there won’t be any delays.

How to get a cashier’s check?

To get this type of check, you will need to visit the bank or the credit union. However, not all financial institutions offer these checks to those who are non-customers. And even if they do, then you might have to part with some fees.

Therefore, you should start with your own bank, where the funds can be from the savings or checking account.

For the bank to offer you the check, you will need an amount to guarantee the cashier’s check. Additionally, you have to indicate the recipient, which can be an individual or institution.

Ensure you have the correct details of the recipient for the transaction to be complete. Otherwise, you will experience challenges with the transaction.

Additionally, if you want this check from the bank where you are a customer, you can get this cheque using your available funds. The bank will then deduct the amount from your account for the cashier’s cheque.

But if you want a check from a credit union or bank where you have not registered before, you need to have the cash.

The bank will then take your money, and in exchange, write you a cashier’s check, which is equivalent to your cash. Most banks require you to visit their facilities to complete this process through a few, i.e., Wells Fargo enables you to order the check online.

But they must process the application, and this could take more than 5 business days. Once it’s written, the check will be valid for 1-3 months, and the recipient should therefore deposit it sooner.

How Much Do a Cashier’s Checks Cost?

The cost of the cashier’s check will vary based on the state and the bank. Bank of America, BB&T, Capital One, and PNC Bank will charge you $10 for a check from the banks' side.

Others like Chase bank, KeyBank, REGIONS, TD Bank, and SunTrust charge $8 for the check. The US bank charges $7 while the Huntington bank charges $6 for the same.

Cashier’s Check Alternatives

Certified Checks

Certified checks are similar to cashier’s, checks but they are directly related to your account. You and the bank will sign the document, but you have to cover the associated fees based on your banks' conditions if you have insufficient funds in your account.

However, it’s not highly secure compared to a check as it does not have a watermark. This makes it easier to replicate, but it’s better than a personal check or money order.

Money Order

Money orders are one of the safest payment methods as you only buy them using cash or credit and debit cards. Therefore, there is no risk of bouncing compared to checks. And besides the banks, you can also buy them from credit unions, retail stores, and post offices.

Personal Checks

When writing personal checks, the funds in your account should be sufficient to complete the transaction. But you can also write the personal check without funds in your account as it will take some business days to complete the transaction.

For instance, your check will spend time in the mail for some days, and the recipient will also take time to deposit it, and there will be time for processing the personal check. Therefore, your account won’t be debited right away after the personal check is deposited.

Therefore, you can use the personal check without any funds in your account, but you are confident that you will get the funds when they are needed. This is the time when the recipient will deposit it to the bank to request payment.

This is referred to as floating checks, and yes, it’s like paying someone in advance and hope the money arrives on time, and it’s illegal.

Wire Transfers

Wire transfers can also be a good alternative, and it's where you send money to the recipient directly without any check. It’s one of the easiest ways to send money, but you may have to contend with high transaction fees compared to checks or money orders.

Most banks charge $14-$50 to complete the wire transfer requests. And if you are transferring money internationally, then you might wait for long before it's completed.

Bottom-line

Writing a cashier’s check is one of the safest ways to make a payment without any risk to your account.

The bank uses its funds for this transaction, and so you won’t need to provide any account details when making the payment. It’s also not easy to duplicate these checks, which makes them ideal for large transactions.